Short term

Last week, once again, there was abundant wind generation in Northwest Europe. Solar generation, on the other hand, remained significantly below the climate average. For example, The Netherlands experienced considerable cloud cover on Thursday, contributing to a substantial increase in electricity prices compared to Germany. In Germany, prices were almost close to 0 in the afternoon, while in the Netherlands, they were above 70 €/MWh – roughly the cost of gas-fired power plants that day.

Weekend forecasts indicated that Germany would have an extremely high amount of renewable generation, with forecasts suggesting that Germany could have +/- 20 GW of surplus power at times on Sunday afternoon. However, it was observed that a significant amount of curtailment (especially from wind farms) occurred on Sunday, indicating that many wind farms were not producing. Ultimately, the average Dutch spot price was 48.9 €/MWh last week, with the average day-ahead gas price at 28.1 €/MWh.

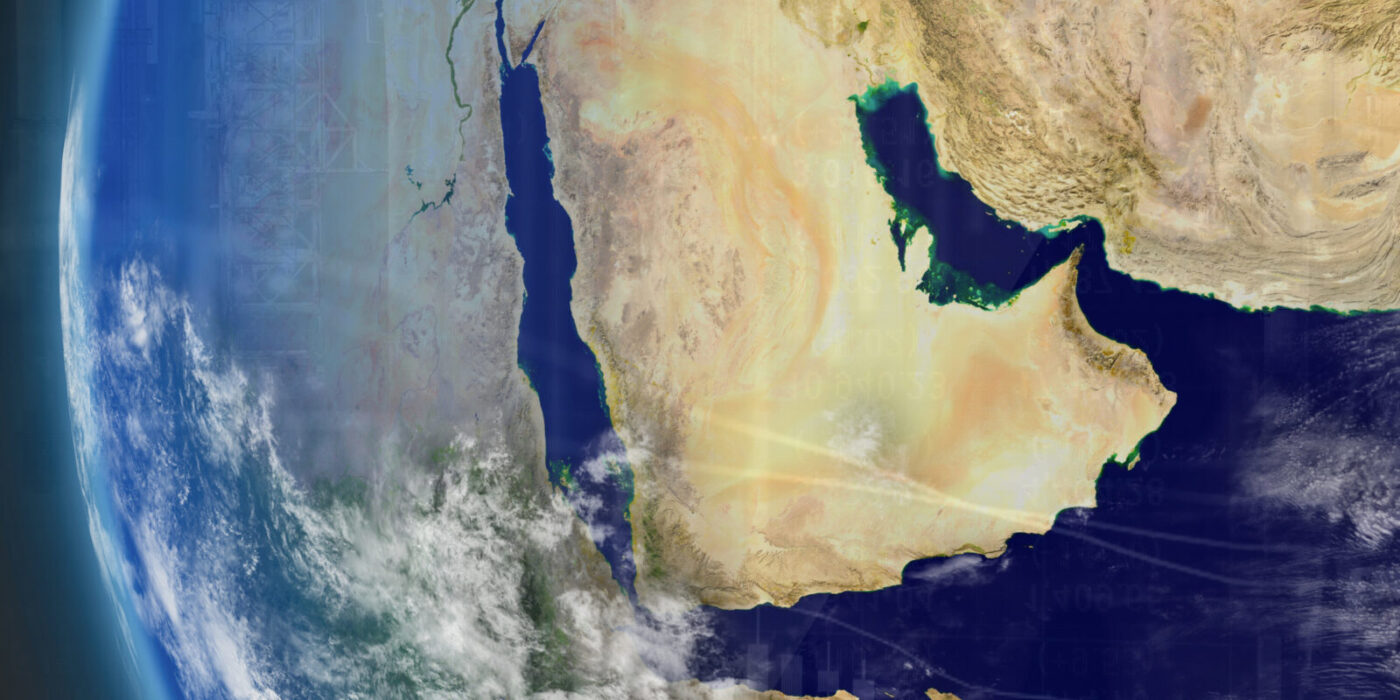

During the week, gas prices rose above 30 €/MWh. Several factors seemed to have contributed to this increase. Iran had threatened to attack Israel several weeks ago, and the United States actively warned at the beginning of the week that an attack would take place. This eventually happened on Saturday evening, after Iran had seized a cargo ship earlier that day in the Strait of Hormuz, through which many cargo ships, transporting oil and LNG, pass. Additionally, weather models indicated that Europe would experience lower temperatures over the next 2 weeks, marking the first time since early January. In France, temperatures on some days were up to 8 degrees above the climate average in April. Furthermore, renewable generation was expected to decrease significantly compared to previous weeks.

CO2 prices rose significantly alongside gas. The CO2 contract for December 2024 ultimately closed 11 euros higher at 71.5 €/EUA. Gas prices for the coming months increased by 4 euros to around 31 €/MWh. While coal prices saw a slight increase, gas-fired power plants generally remain cheaper, particularly due to the significant rise in CO2 prices. Dutch power for May and June closed approximately 12 euros higher at 59 and 64.3 €/MWh, respectively.

Electricity (€/MWh)

Gas (€/MWh)

Note: Gas prices are listed in €/MWh (100 €/MWh is equal to 0.97694 €/Nm3, based on a conversion formula/factor 35.17 / 3600 = 0.0097694).

Lange termijn

State-owned French EDF reported last week that it expects to continue addressing corrosion issues at its nuclear power plants until at least the end of 2025. Several weeks ago, problems were identified at a nuclear power plant, causing French power contracts for the winter to briefly surge. A company spokesperson stated that corrosion was found in a type of nuclear power plant where EDF did not expect to encounter it.

The gas price for 2025 increased significantly by 4.5 euros to almost 36 €/MWh. CO2 for next year settled at 74.3 €/EUA. The Dutch power contract increased by almost 13 euros to 88.7 €/MWh. The clean dark spread remained unchanged and remained negative at -6.4 €/MWh.

Base (€/MWh)

Peak (€/MWh)

Gas (€/MWh)

Let op: de gasprijzen worden vermeld in €/MWh (100 €/MWh is 0,97694 €/Nm3, gebaseerd op een omrekenformule/factor 35,17 / 3600 = 0,0097694).

CO2 (€/EUA)

Benieuwd wat deze informatie kan betekenen voor uw bedrijf?

"*" indicates required fields