We are excited to announce that Alex Halsema, Teamlead of Asset Optimization at PZEM, will be a speaker at the Power Price Forecasting Summit 2023 taking place on January 26th and 27th in Amsterdam. On Friday January 27th, 2023 Alex will share his insights and expertise on the topic of “Price Forecasting and Ancillary Services.” The summit will focus on the increasing volatility of energy supply and the growing need for improved electricity price forecasting analysis.

Asset Optimisation & Trading consists of 3 sub teams: Asset Optimisation, Trading and Shift Trading

Onze rol

Vanuit ons portfolio hebben wij een uitgekiende mix van gas, wind-, zonne- en kernenergie. Daarbij wordt er een minimale hoeveelheid CO2-uitgestoot. Maar liefst 40% van onze energie wekken we op uit duurzame bronnen. Zo nemen we door langjarige afnamecontracten duurzame elektriciteit af van een aantal grote en kleine windparken. En door diverse gasopslag- en transportcontracten weten we onze klanten en centrales altijd van voldoende gas te verzekeren.

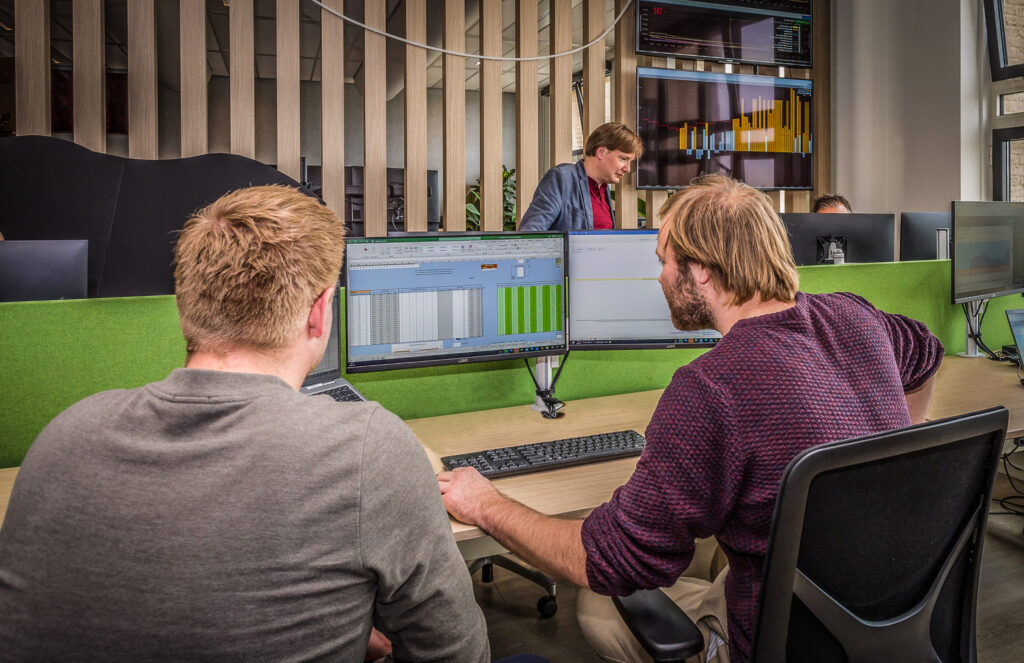

Via onze handelsvloer verhandelt PZEM continu energie. We kennen de energiemarkt door en door en weten precies wat onze partners en klanten nodig hebben. Daarbij komt dat we onze portefeuille kunnen verbinden aan zeer flexibele productie-, transport- en opslagcapaciteiten. En omdat we met onze 24/7 trading desk voortdurend toegang hebben tot alle relevante energiemarkten zijn we uitstekend in staat om risico’s te beheersen en kosten te minimaliseren. Met dank aan onze traders, analisten en risicomanagers die steeds weer fantastische resultaten voor ons weten te behalen.

Door maatwerk of gestandaardiseerde contracten via ons online portaal kunnen we onze (groot)zakelijke klanten één, twee of drie jaar energie leveren. Altijd tegen een zo’n scherp mogelijke prijs en met een service die uw behoefte centraal stelt.

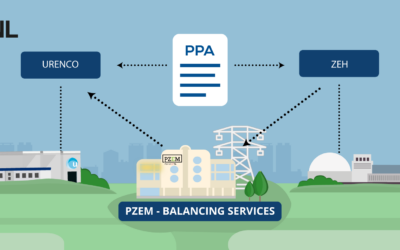

Asset Optimisation creates value to our portfolio by optimizing contracts. Predictions of customer demand, wind and solar production, are used as input for the daily optimization of our portfolio. In addition, they also manage the contracts that PZEM has with the assets. This involves, amongst others, analyzing investments, optimizations, and maintenance plans.

Trading is responsible for hedging and optimising the portfolio through long-term contract trading and does so within the set risk limits and according to approved lock-in strategies. The focus is on gas, electricity and CO2, these markets are hedged so that the portfolio is covered. This includes safeguarding the B2B portfolio.

Shift Trading is responsible for optimizing the electricity and gas portfolio in the short term intraday and imbalance markets. Shift Trading is continuously and 24/7 balancing this portfolio. They do this by trading on the trading market or raising or lowering an asset.

Our assets are the heartbeat of our company. Our gas-fired power plants provide clean, efficient, and adaptable solutions to meet the increasing demand for flexible and renewable energy in the electricity supply.

We focus on supplying electricity and gas to mid and large businesses, offering customized contracts and automated processes. Additionally, our Origination & Structure division provides energy products and aims to create a portfolio with an optimal risk-return ratio for our clients

Alex Halsema - Teamlead Asset Optimisation at PZEM

Do you want more information about the topics or do you want to get in touch with us or Alex click on the button below.